13 Benefits of xP&A for Your Enterprise Success

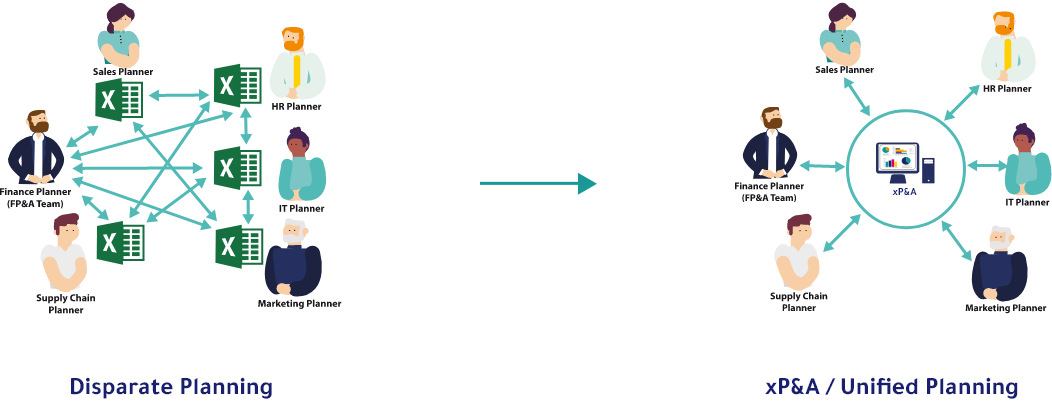

If you’re looking for a way to improve communication and collaboration within your organization, then you may want to consider implementing XP&A. XP&A is a process that can help your team work more effectively and efficiently by providing a framework for better communication and coordination.

Why Do Organizations Need Extended Planning & Analysis?

There are a few key reasons why organizations need to engage in extended planning and analysis. One reason is that it allows for a more comprehensive understanding of the organization’s current situation.

By taking the time to examine all aspects of the business, planners can get a clear picture of where the company stands and what needs to be done in order to improve performance.

Additionally, extended planning and analysis can help identify potential opportunities and threats that the organization may face in the future. This information can then be used to develop strategies that will help the company capitalize on opportunities and mitigate any potential risks.

Finally, extensive planning and analysis can also help organizations better understand their customers and how they can best meet their needs. By understanding what customers want and need, businesses can create products and services that are more likely to be successful.

How Can xP&A Help Organizations?

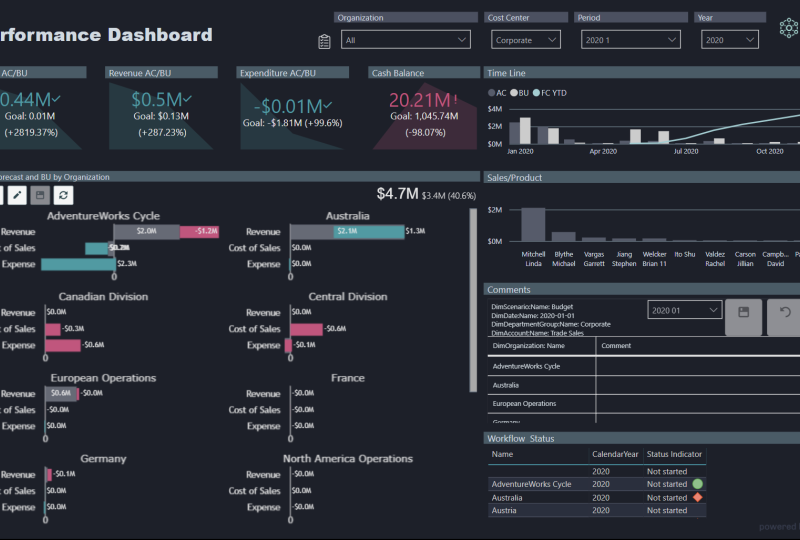

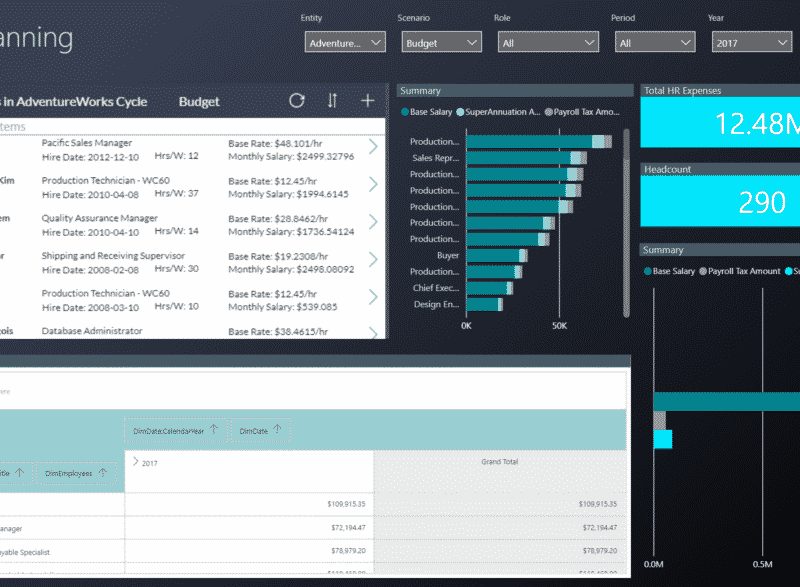

xP&A helps organizations by allowing for the efficient and accurate tracking of employee performance and assessment. This allows managers to identify areas in which employees need improvement and to make the necessary changes in order to improve productivity and efficiency. Additionally, xP&A can help to ensure that employees are being properly compensated for their work by providing an accurate record of their contributions.

List of Benefits of xP&A for Businesses

xP&A for businesses can provide a number of benefits, including:

1. Increases Transparency:

xP&A for Businesses can help to increase transparency within a company by providing a secure and easy way to share documents and data between employees. This can help to improve communication and collaboration, which can in turn lead to increased efficiency and productivity. Additionally, xP&A can help businesses to comply with regulations and audit requirements by providing a secure and tamper-proof audit trail.

2. Business Alignment:

There are a number of benefits that businesses can experience when they implement xP&A. One of the most important benefits is that it can help to improve business alignment. When businesses are aligned, they are working together towards the same goals and objectives. This can lead to improved efficiency and productivity, as well as reduced costs. Additionally, xP&A can help to improve communication between departments and employees. This can lead to a more cohesive workplace, where everyone is working together towards the same goal. Finally, xP&A can also help businesses to better understand their customers and how they interact with their products or services. This can help businesses to make better decisions about how to meet the needs of their customers and improve their bottom line.

3. Streamlined continuous planning:

xP&A can help businesses streamline their continuous planning process by automating the planning process, businesses can save time and ensure that their plans are always up-to-date. This can help businesses stay agile and responsive to changes in the market and optimize their operations accordingly.

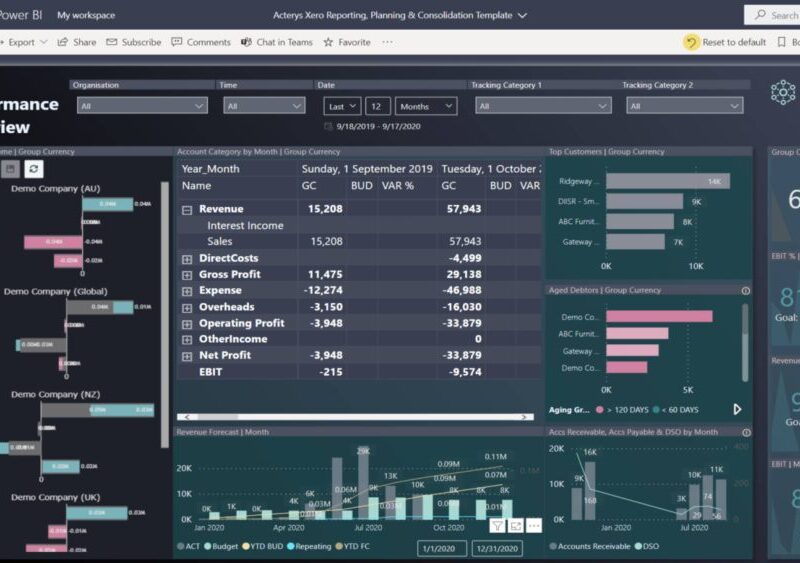

4. Reliable data management:

xP&A can help businesses manage their data more reliably. By consolidating data into a single system, businesses can reduce the chances of data loss or corruption. Additionally, xP&A can automate many tasks related to data management, such as data entry and retrieval. This can help businesses save time and money.

xP&A can help businesses improve their customer service. By providing customers with easy access to their account information, businesses can make it easier for customers to manage their accounts. This can improve customer satisfaction and loyalty.

5. Business partnering enablement:

Business partnering enablement through xP&A can provide a number of benefits for businesses. The first benefit is that it can help businesses to identify and assess potential partnerships. By using xP&A, businesses can quickly and easily gather information about potential partners, including their business capabilities and areas of expertise. This information can help businesses to determine whether or not a potential partnership is worth pursuing further.

Another benefit of business partnering enablement through xP&A is that it can help businesses to build stronger relationships with their partners. By using xP&A, businesses can share more information with their partners, which can help to strengthen the relationship. Additionally, by using xP&A to track the performance of partnerships, businesses can ensure that they are getting the most out of their partnerships and that both parties are meeting their expectations.

6. Holistic View of Your Organization:

xp&A provides a holistic view of your organization, breaking down silos and connecting different parts of the business. This comprehensive view helps you identify inefficiencies and problems that may be hindering growth. xp&A also provides valuable insights into customer behavior and preferences. With this information, you can make better strategic decisions about what products and services to offer and how to market them. xp&A can also help you identify areas where you can cut costs or improve efficiency. Overall, xp&A provides a detailed view of your organization that can help you grow your business.

7. xp&A Fosters Agility:

xp&A fosters agility by allowing businesses to rapidly adapt to changing markets and requirements. The software helps businesses to optimize their processes and workflows, improving efficiency and responsiveness. Additionally, xp&A can help businesses to identify opportunities and threats quickly, making it possible to take advantage of new opportunities and protect against potential threats.

8. Provides a Single Source of Truth:

xP&A for Businesses provides a single source of truth for businesses. This means that businesses can rely on xP&A for all of their business needs, from accounting to marketing to human resources. Having a single source of truth ensures that businesses have consistent and accurate information, which can help them make better decisions and grow their businesses. Additionally, xP&A for Businesses is updated regularly, so businesses can rely on the latest information when making decisions.

9. xP&A Enables Scaling:

Businesses can take advantage of xP&A to enable scaling. By using xP&A, businesses can easily and quickly increase or decrease their capacity as needed. This flexibility is important for businesses that are growing or changing quickly. Additionally, businesses can use xP&A to better match their service capacity with current customer demand. This ensures that businesses are providing the best possible customer experience while also maximizing their efficiency.

10. Increased efficiency:

By addressing bottlenecks in the organization’s processes, XP&A can help increase efficiency and output. This can lead to significant savings in time and money for the organization.

11. Increased competitiveness:

XP&A can help an organization stay competitive by allowing it to respond quickly to changes in the market or new opportunities. This agility can be a key differentiator in today’s economy.

12. Effective Strategy:

It can help you develop a more effective strategy for addressing the problem or taking advantage of the opportunity.

13. Asses Risks & Rewards:

It can help you better assess the risks and potential rewards associated with different courses of action.

How to Transition to xP&A from FP&A?

The first step in transitioning to Extended Planning & Analysis (xP&A) from Financial Planning & Analysis (fp&A) is to identify the key differences between the two accounting models. The most fundamental difference is that xP&A is based on a principles-based approach, while fp&A is based on a rules-based approach. This means that xP&A relies on broad principles to guide decision-making, while fp&A relies on specific rules to dictate how transactions should be recorded and reported.

Another key difference is that xP&A allows for more flexibility in accounting treatment, while fp&A is more restrictive. For example, under xP&A, companies can choose the accounting method that best reflects their business operations, while under fp&A they are required to use the specific procedures prescribed by the accounting standards.

Finally, xP&A is intended to provide a more accurate and informative representation of a company’s financial position and performance, while fp&A is primarily focused on compliance with financial reporting standards. Therefore, if you are looking for a more in-depth understanding of your company’s financials, then xP&A may be a better choice for you than fp&A.