FP&A vs XP&A: What is the Difference?

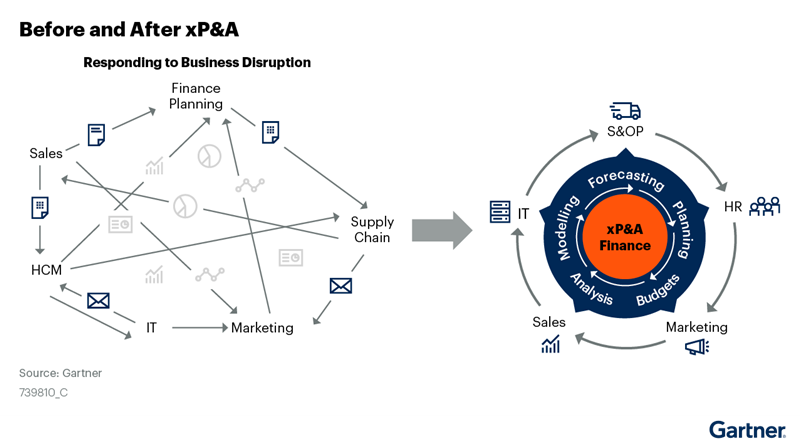

FP&A and XP&A are two different financial planning and analysis methods. FP&A is a more traditional approach that focuses on long-term planning and forecasting. XP&A is a newer approach that emphasizes real-time decision making and responsiveness to changes in the market.

The main difference between FP&A and XP&A is the focus on short-term vs long-term planning. FP&A is better suited for companies that want to plan for the future and make strategic decisions, while XP&A is better for companies that need to be more reactive to changes in the market.

What is FP&A?

FP&A is a process and set of practices that support an organization’s financial planning and analysis activities. FP&A includes gathering financial data, forecasting future performance, assessing risks and opportunities, and recommending actions to improve performance. The goal of FP&A is to help organizations make sound financial decisions based on accurate and timely information.

Start Extended Planning & Analysis (xP&A): Any Source, Exactly As Needed

The Complete FP&A Process

Here is the complete process for FP&A activities.

1. Establishing performance goals:

To establish performance goals, FP&A analysts begin by looking at the company’s strategic objectives. They then develop targets that support these objectives and are achievable based on past performance and market conditions. Once the targets are set, analysts track progress against them on a regular basis to ensure that the company remains on track to meet its goals.

2. Forecasting future performance:

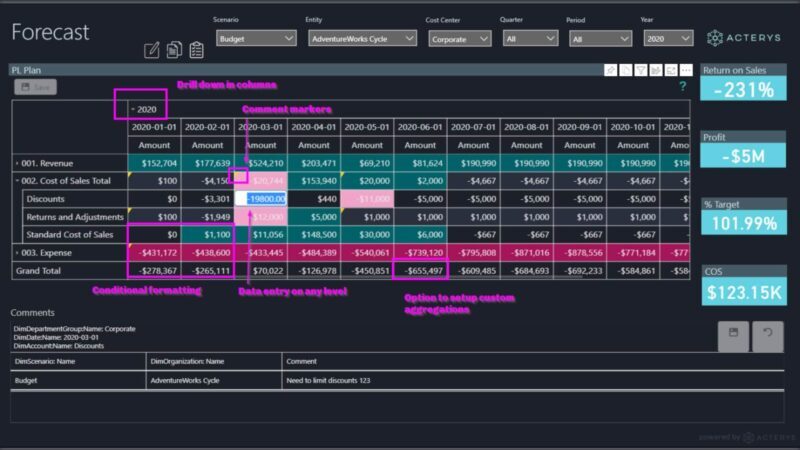

Forecasting future performance is a key process for FP&A. In order to make accurate forecasts, FP&A teams need to have a good understanding of past performance and current trends. They also need to be able to predict how changes in various factors will impact future performance. Forecasting is an ongoing process, and FP&A teams should regularly update their forecasts as new information becomes available.

3. Analyzing results and trends:

FP&A analysts are responsible for reviewing financial results and trends in order to identify any potential issues or areas of concern. They may also look for opportunities to improve performance and profitability. In order to do this effectively, analysts must be able to understand and interpret financial data. They must also be able to use analytical tools and techniques to spot trends and patterns.

4. Adjusting plans as necessary:

FP&A teams need to be able to adjust their plans as necessary in order to reflect the most current information and changing circumstances. This may involve revising targets, assumptions, and forecasts as needed. Being able to make changes quickly and effectively is critical for ensuring that the team can continue to provide accurate information to the organization.

Benefits of FP&A

FP&A helps organizations better understand their financial position and performance by providing insights into past financial results and future potential. FP&A also assists in the formulation of corporate strategy by providing analysis of business opportunities and potential risks. Additionally, FP&A can help improve decision-making by forecasting future financial results and highlighting key trends. Ultimately, FP&A plays a critical role in ensuring that an organization’s financial resources are best used to support its strategic objectives.

There are many benefits to having a well-functioning FP&A department. Some of these benefits include:

1. Improved decision making – By having accurate, timely financial information, management can make better decisions about where to allocate resources and how to grow the business.

2. Increased efficiency – By having all the financial data in one place, FP&A analysts can easily spot trends and identify inefficiencies. This allows for faster and more accurate reporting.

3. Better strategic planning – FP&A can help management develop a clearer understanding of the company’s financial position and future prospects, which is essential for successful strategic planning.

4. More informed decision making – Having an FP&A department ensures that all stakeholders (management, employees, investors, etc.) have access to timely and accurate financial information. This helps everyone make better decisions based on sound financial data.

Example of FP&A

When it comes to financial planning and analysis, there is no one-size-fits-all approach. The best way to achieve success in this field is to tailor your strategy to the specific situation at hand. In order to make sound financial decisions, you need to have a clear understanding of the company’s current state and its potential future growth.

The purpose of financial planning and analysis is to ensure that a company has the resources it needs to achieve its goals. Financial planning involves forecasting future revenue and expenses, and then creating a plan to ensure that the company has enough money to cover its costs. Financial analysis is used to track actual results against the forecast, and to make adjustments to the plan as necessary. By using financial planning and analysis, a company can make sure that its finances are in order and that it is on track to meet its goals.

Financial planning and analysis is a complex but essential part of running a successful business. If you can master these skills, you will be able to make informed decisions that will benefit your company in the long run

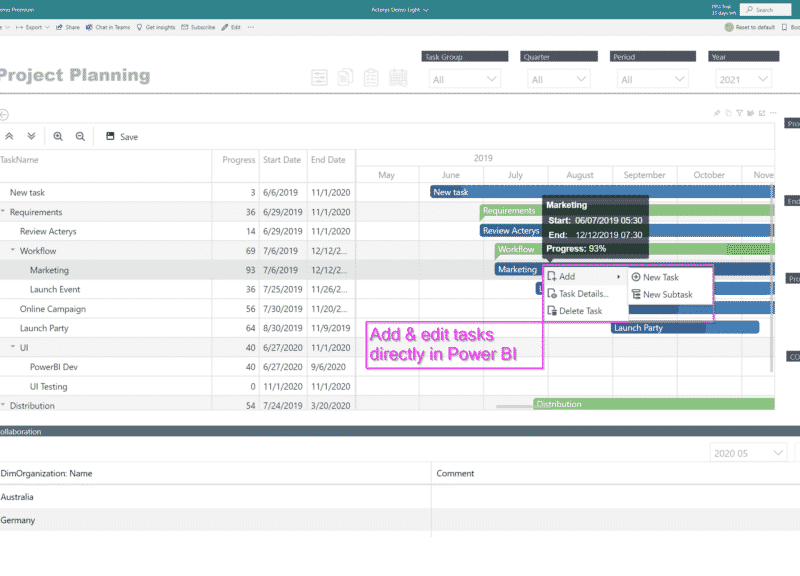

Read: Effective Planning Process in Power BI & Excel

What is xP&A

Extended planning and analysis (xP&A) is a comprehensive problem-solving methodology that incorporates principles of systems thinking, decision analysis, and risk management to support long-term decision making. xP&A integrates stakeholder values into the analysis to ensure that decisions are made in the best interests of all involved. It can be used for any decision where there is significant uncertainty and risk, such as capital investments, business strategy, product development, and policy formulation.

The Complete Process for xP&A

The process for xP&A is as follows:

1. Determine Objectives

The first step in the process for xP&A is to create a project plan. This document will outline the goals of the project, the steps that will be taken to achieve those goals, and the resources that will be needed.

2. Identify Target Units

The second step is to identify the target audience for the project. This includes figuring out who will be using the product or service and what needs they have.

3. Develop a plan to improve the organization’s strengths and address its weaknesses

The organization should develop a plan to expand its product offerings and to introduce new and innovative products. The organization should also work to reduce its debt levels, so that it can free up cash to reinvest in the business.

4. Track Progress

The final step is to track progress and make necessary adjustments to the plan as needed.

Benefits of xP&A

xP&A (Extended planning and analysis) is a process that helps organizations optimize their operations by improving the flow of information and communication. The main benefits of using xp&a are:

1. Improved decision making – xp&a allows for better and faster decision making by providing all stakeholders with the same information in a timely manner. This helps to avoid confusion and delays.

2. Increased efficiency – xp&a helps to streamline operations by eliminating the need for multiple meetings, emails, and phone calls. This results in increased efficiency and a reduction in wasted time and resources.

3. Enhanced communication – xp&a facilitates better communication between team members by allowing them to share information quickly and easily. This leads to a more coordinated effort and a reduction in mistakes.

4. Greater transparency – xp&a promotes transparency throughout the organization by making information available to everyone who needs it. This allows employees to make better informed decisions and contribute more effectively to the organization’s success.

Examples of xP&A

One example of extended planning and analysis is a business creating a long-term strategic plan. This plan will outline the goals of the company and how they will be achieved over a period of several years. The plan will also include detailed budgets and forecasts to help ensure that the company is on track to meeting its goals.

Another example of extended planning and analysis is when a person creates a budget for themselves. They may create a budget that covers their expenses for an entire year, or even longer. This will allow them to track their spending and make adjustments as needed in order to stay on budget.

Learn How Star Group automates data warehouse loading processes from Xero companies

Conclusion: FP&A vs xP&A

FP&A and XP&A are two different job functions in organizations. FP&A is responsible for financial planning and analysis, while XP&A is responsible for extended planning and analysis.

The main difference between these two job functions is that FP&A is focused on the past and present, while XP&A is focused on the future. FP&A is responsible for tracking financial performance and making recommendations based on that data. XP&A is responsible for coming up with ideas for new products or services and figuring out how to make them a reality.

So which job function is more important? That depends on the organization. If the organization is looking to improve its financial performance, then FP&A is more important. If the organization is looking to innovate and grow, then XP&A is more important.