Sensitivity Analysis vs Scenario Analysis: What’s the Difference

Every business choice involves making certain predictions, and those predictions include some measure of uncertainty. Knowing how to effectively apply analytical and forecasting techniques to these predictions is vital for assessing risks. It also helps analysts weigh against possible rewards, even though you may never have the capacity to see the ultimate conclusion of every business action before making it.

But how is sensitivity analysis different from scenario analysis? Let’s learn all about it in detail below.

Main Differences: Sensitivity Analysis vs. Scenario Analysis

The key distinction between scenario analysis and sensitivity analysis is that Sensitivity Analysis evaluates the impact of a single variable change, whereas Scenario Analysis considers the impact of several changes simultaneously. Both are techniques for assessing how dangerous certain circumstances really are for the organization.

When To Use Scenario Analysis?

Nothing in life or business is guaranteed. To assist in strategic decision making, you can use scenario analysis to systematically investigate the potential results of various scenarios.

To be clear, the purpose of scenario analysis is not to make any kind of prediction about the outcomes of hypothetical situations. Instead, it takes a more nuanced approach by considering a spectrum of possibilities, from the best-case to the worst-case. By doing so, you may better plan for a wide range of contingencies and respond quickly to changing circumstances, all this enables you to achieve your company goals even if they shift.

Scenario analysis enables a more preemptive evaluation of possible risk, which in turn leads to improved decision making. It places less emphasis on pinpointing exact results and more on forecasting a range of viable, though uncertain, possibilities. Applying this method to corporate problems may help people think more systematically and more clearly about where to put their resources.

Unfortunately, there are drawbacks to using scenario analysis. It’s a lengthy procedure that often calls for some specialized knowledge and abilities. However, there are planning systems available to take into account the many outcomes that this kind of scenario can offer.

How to Conduct Scenario Analysis?

As a financial analyst, you can conduct scenario analysis by…

- Setting up a baseline. Any widely held beliefs or expectations regarding the company’s future would fall under this category. Projected revenues, different expenditure lines, and cost of capital would all be used in this retail center investment analysis.

- Creating several possible outcomes by varying certain inputs and assumptions. Capital expenditures, additional cash outflows, and anticipated revenue growth would all be inputs and assumptions. The typical set of scenario results would comprise the best case, the worst case, and maybe one or two additional cases.

- Examine financial model metrics. Internal rate of return (IRR), payback time, and net present value (NPV) are three of the most essential valuation measures that might be generated by the model.

- Delivering analysis-based insights to decision-makers. Leaders would likely consider pushing through with the investment if the most likely scenarios suggested the intended IRR would be reached. If possible, a corporation would want to have an internal rate of return (IRR) that is greater than its cost of capital. It seems to be the reason that a real estate development firm with a cost of capital of 10 percent will seek out investments with returns in excess of 10 percent.

When To Use Sensitivity Analysis?

Sensitivity analysis, also known as “what-if” analysis, is a subset of scenario analysis that explores the impact of changing only one input in the scenario.

As it examines the probabilities of success and failure for many scenarios, sensitivity analysis is useful for fact checking and presenting a comprehensive prediction. This form of forecasting may be used in a business environment to estimate the project’s ROI.

How to Conduct Scenario Analysis?

Let’s take the example of a company called ABC Inc. that produces cutting-edge tools for the kitchen. The corporation develops a new device that can both cook and clean up after its use. It will take approximately a year to bring the product to market, and during that time, economic circumstances are expected to deteriorate, according to financial experts.

Scenario analysis would allow the corporation to consider how several economic scenarios would affect the new product’s sales and earnings. Numerous elements, including but not limited to client demand and the price of raw materials, may be influenced by the state of the economy. The corporation has a lot of options that might lead to various assumptions.

One possible outcome is a 20% drop in sales as a result of weaker consumer demand brought on by the economy, coupled with a 5% increase in raw material costs as a result of supplier bankruptcies and less market competitiveness. Manufacturing start-up expenditures may be financed at a cheaper borrowing rate, and rent on manufacturing premises may decrease by 10%. The influence of each of these aspects might be evaluated using scenario planning.

Forecasting by Combining Both Scenario & Sensitivity Analysis Methods

Is it more effective to utilize sensitivity analysis in addition to scenario analysis, or to apply each technique independently? There are numerous practical uses for the two together. In this way, you may better prepare for a variety of scenarios by getting a bird’s-eye view of the situation.

Think about a university that wants to construct a new student center on campus. As a means of gauging the efficacy of their expenditure, they decide to use a statistical model of the economy. They start by analyzing the best-case scenario, the worst-case scenario, and the baseline.

More detailed data on one of these possibilities may then be obtained via a sensitivity study. It’s possible that the school is considering how a 5-percent swing in income would influence their bottom line before deciding whether or not to proceed with this expenditure. What portion of your expenses may you adjust to account for the drop in revenue? Although rent cannot be negotiated, can the center’s capacity to manage other expenses (such as employee pay, operating expenditures, etc.) ensure a healthy bottom line? For the school administration to have a better idea of how much money should be allocated for this endeavor, a sensitivity analysis should be performed.

Neither sensitivity analysis nor scenario analysis, taken alone, would provide a whole picture. Ultimately, combining the two approaches to scenario planning will improve forecasting accuracy and reduce risk. And with a comprehensive planning tool like Vena, it’s a breeze.

In what ways, if any, are sensitivity and scenario assessments more effective when used jointly as opposed to separately?

Scenario and sensitivity assessments are complementary tools that may help a business see all of the possible outcomes of a given circumstance.

Let’s circle back to our made-up real estate development firm that’s thinking about buying into a retail mall. The finance department could run a few what-if models, covering the best and worst case possibilities.

Sample Best Case Scenario:

- Lower initial investment expense

- Strong economic conditions

- Better than average revenue growth

Sample Worst Case Scenario:

- Deteriorating economy

- Lower revenue growth

- Expenses going over budget

Strategically Position Your Business Through Analysis and Complete Planning

No one can foresee what will happen in the future, but they may take steps to prepare for it, and with Vena’s assistance, even the unanswered questions are manageable when supported by predictive modeling.

Risk may be reduced by adaptive scenario planning with the help of our scenario planning and analysis tools. We use a centralized database to store real-time information, giving you a clear view of your company’s financial standing so you can make educated choices.

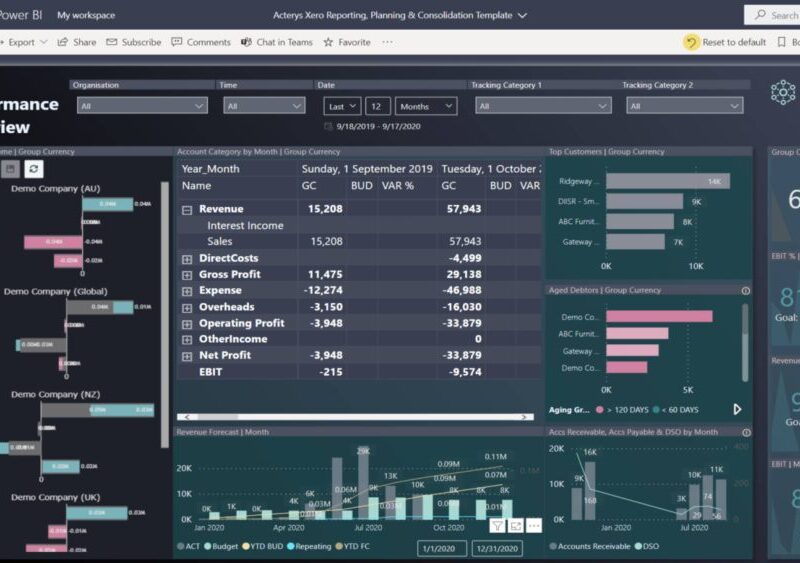

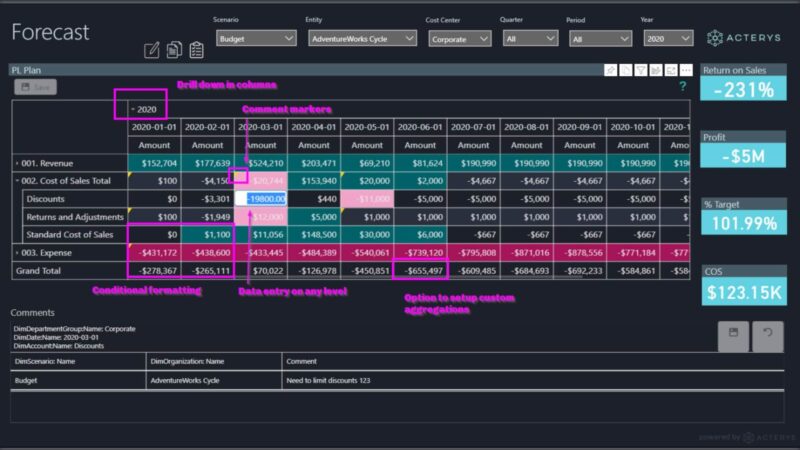

With Acterys you get:

- Unified Planning & Reporting Platform

- Built-in Process Templates

- Scale your processes while staying within Excel

- End-to-end analytics solutions for major cloud accounting, ERP and CRM systems